CNMI & AMERICAN SAMOA

Taxes for Farmers Presentation_CNMI & AMERICAN SAMOA

Tax Forms for CNMI (2023)

1040-cm

1040nmi

1040-s1cm

GUAM

Taxes for Farmers Presentation_GUAM

Guam Department of Agriculture

163 Dairy Road Mangilao, Guam 96913

(671)-300-7973

Website: doag.guam.gov

Bona Fide Farmer Certification

Bona Fide Application (Agriculture Assessment Form)

Bona Fide Farmer General Requirements

Steps to Becoming a Guam Bona Fide Farmer

Six Month Farm Report

Completed forms can be submitted in person or emailed to: agriculture@doag.guam.gov

You must have your Bona Fide Certification in order to legally sell produce on Guam (Bill No 63-36)

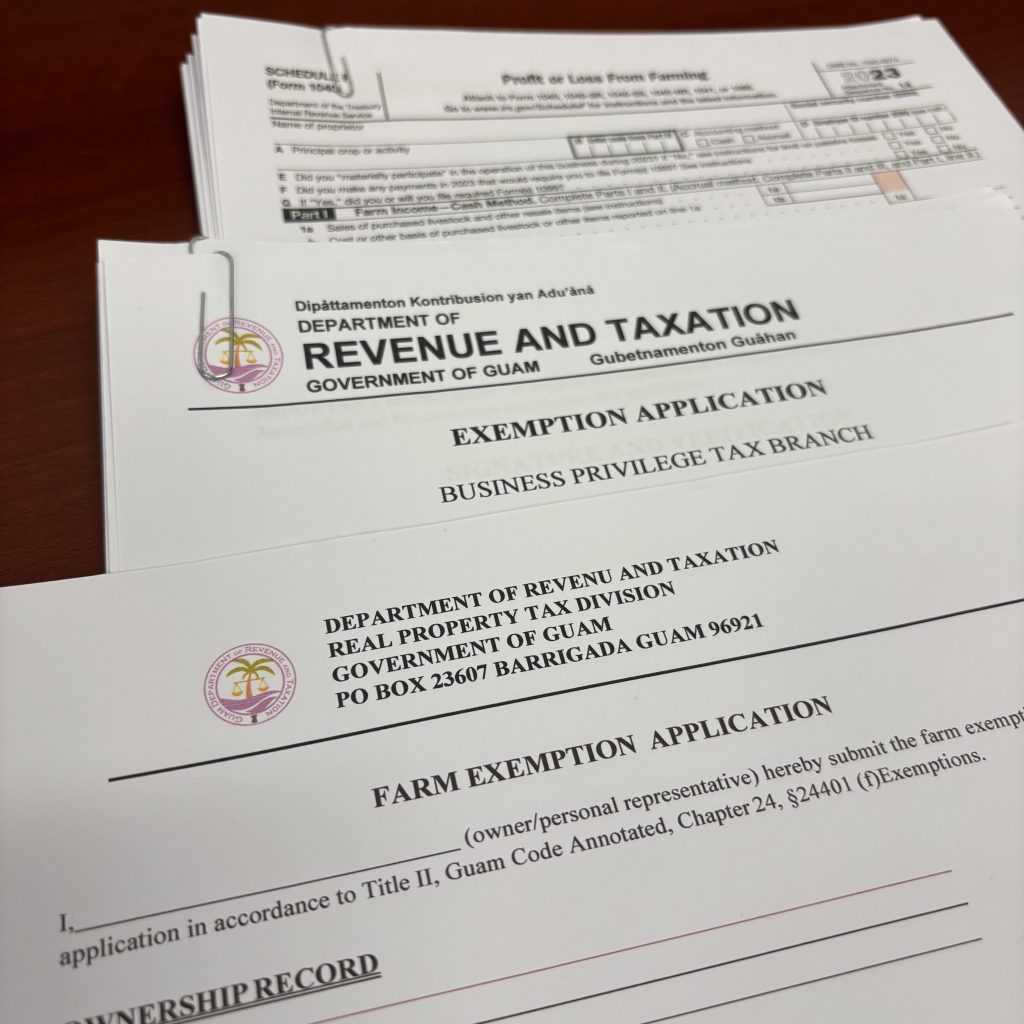

Guam Department of Revenue and Taxation

1240 Army Drive

Barrigada, Guam 96913

(671)635-1840

Farmer Exemption Application

Farmer Exemption Application (Property Tax)

Annual Information Return for Tax Exempt Persons (Form CN 2-2-111)

Schedule F (Profit and Loss of Farming)

Weights and Measures Fees (Scales)

*Farmers should obtain a certificate of exemption from Guam Department of Revenue and Taxation after obtaining their Bona Fide Farmer Certificate, so that they can support their right to sell their whole, uncut, or natural state produce as Commercial or Self-sustaining farmers, without further licensing.

Licensing, Tax Exemptions and Compliance with the Law: Guam

Bona Fide Farmer Definition; Per amended Guam Code Title 5, Chapter 63, Article 8, ss63801b:

“Bona fide farmer means a person who is registered with the Department of Agriculture who grows for commercial purposes fruits, vegetables, ornamental plants, livestock, aquacultural products, agricultural products, or similar products, and is either (1) a U.S. Citizen,; (2) a permanent resident alien; (3) a non-immigrant alien admitted into Guam under the Compacts of Free Association between the United States and the Federated States of Micronesia the Republic of the Marshall Islands, and the Republic of Palau; (4) a resident of Guam for the immediately preceding five (5) years; or (5) a corporation or partnership licensed to do business in Guam. There shall be no requirement on the minimum size of a farm, acreage, or number of plants needed in order to register with the Department of Agriculture as a bona fide farmer…”

Per PL 36-24 (Bill 63-36): “Requiring Farmers to Be Certified as Bona Fide Farmers to sell locally grown produce or aquaculture products and to suspend or revoke business licenses from companies found in violation.”

Business License Law Guam: Per Guam Code Title 11, Division 3, Chapter 70 ss 70126b

“NO further business license is required for farmers to sell their WHOLE UNCUT PRODUCE SOLD IN ITS NATURAL STATE.”

Business Privilege Tax Law: Per Guam Code Title 11 Division 3, Chapter 26, ss 26203b

“Farmers selling their own produce are exempt from the Business Privilege Tax (GRT)”

Additional Resources

Home Office Deduction Worksheet for Farmers

Business Use of Home for Schedule F_ Publ 587 pg 20

Expense Asset and Vehicle Recordkeeping Workbook 2024

Register for Tax Consultation Services